- Dated 23/08/23 – Fund Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Absolute Return Fund (ABW), Aurora Dividend Income Trust (ADIT), Aurora Fortitude Absolute Return Fund (AFARF), Aurora Global Income Trust (AIB), Aurora Property Buy-Write Income Trust (AUP) and HHY Fund (HHY) (collectively the Funds) provides the following market update, where applicable, in relation to the Funds’ investments in RNY Property Trust (RNY) and Molopo Energy Limited (Molopo).

This Fund Update is supplementary to, and should be read in conjunction with, the earlier Fund update provided on 23 February 2023.

RNY Property Trust update

RNY Property Trust (RNY) is an Australian unlisted property trust with five (5) commercial property assets located in the tri-state area of New York, USA, with 3 properties located in Long Island and 2 properties located in Westchester County, collectively having 830,000 sq feet of lettable office space. Huntley Management Limited is the responsible entity for RNY and Aurora Funds Management Limited is the investment manager.

In August 2021, RNY’s US lender to RNY Australia Operating Company (US LLC), ACORE Capital (‘the Lender’), advised that it would not extend the Loan facility through to October 2022, as contracted, as the Lender considered that documents relating to the net worth test were not administratively executed to its satisfaction and constituted an event of default. Aurora refutes the position adopted by the Lender and notes that the Lender nonetheless continues to rely upon the documents.

In late 2022, the Lender took steps to enforce its security by seeking to commence foreclosure action, seeking to appoint a receiver, and selling the mezzanine debt in the US properties through a Uniform Commercial Code (UCC) auction process. ACORE also advised that default interest of circa US$11 million was due under the loan, however provided no formal paperwork to support this was claim. The UCC auction process was ultimately cancelled after RNY’s related entity, RAOC, acquired the mezzanine debt and paid the associated fees (circa US$1 million).

In March 2023, the Supreme Court of the State of New York County of Nassau (in Long Island) appointed a Rent Receiver over the five RNY properties, being a party independent of the party nominated by the Lender. The Rent Receiver posted a bond and filed an Oath with the Court around 11 April 2023, thereby formalising his appointment. Notwithstanding this appointment, CBRE continues to manage the RNY properties.

Based on recent discussions with the Rent Receiver:

The strong leasing activity and Letters of Leasing Intent at Tarrytown prior to the Rent Receivers appointment, as mentioned in the last Fund Update of 23 February 2023, have not materialised and no new leases have been executed since March 2023; and

The Rent Receiver’s remuneration is based on a % of cash receipts and expenditures (including operating costs and capital expenditure) rather than a time-based arrangement.

Aurora denies that the Group was in breach of the loan obligations and continues to defend the enforcement actions taken by the Lender. In the meantime, the additional expenses associated with the Rent Receiver represent a permanent diminution in value for RNY unitholders.

RNY owns 100% of RNY Australia LPT Corp (Maryland REIT) which in turn owns 75% of RNY Australia Operating Company LC (US LLC), which in turn owns the five RNY properties in separately held subsidiaries. Aurora and parties associated with it, including its Funds, own 79.9% of the units in RNY, with Keybridge Capital Limited (ASX: KBC) holding 17.3% and the remaining unitholders holding 2.8%.

Since the last Fund Update, attempts have been made to resolve the deadlock situation with the Lender. Until this matter is satisfactorily resolved, and a new debt facility can be agreed, there is significant uncertainty regarding the valuation of the subordinated loans and equity interests in RNY.

The Lender has, on several occasions, expressed interest in taking over ownership of the RNY properties, however, has stated that it would only be prepared to offer token consideration.

Based on the uncertainty created by the Lenders actions as outlined above, including unsupported claims for default interest, the Aurora Board considers it appropriate to fully impair to nil the carrying value of its equity investments in RNY and the subordinated loans it has advanced to RAOC, until such time as the impasse with the Lender can be resolved.

The fair value of the RNY equity investments and subordinated loans is based on significant estimates and judgements adopted by the Board of Aurora based on all available information about RNY as at the current date. The Aurora Board is aware of the material impact this decision will have on Aurora and its Funds.

Further, Aurora notes that RNY’s second largest unitholder, Keybridge, has fully impaired the carrying values of its 17.3% equity investment in RNY as well as the subordinated loan it advanced to RAOC (which was used to acquire the mezzanine debt in the US properties). Keybridge has stated that the recoverability of its interests in RNY is dependent upon the prevailing market value of the underlying US properties less the senior debt. Further, given the state of the broader market, expectations on property values and the status of the dispute with RNY’s Lender, Keybridge considers its subjective valuation to be appropriate.

The Aurora Board considered the range of possible values and determined that the fair value of the RNY equity investments and subordinated loans held by Aurora and its Funds should now be valued at nil.

Aurora will continue to pursue its options to resolve the deadlock with the Lender.

Molopo Energy update

In a letter to shareholders, dated 2 May 2023, Molopo Energy Limited (Molopo) advised “the Company has approximately AUD$16.9 million in cash and a debt owing to Molopo from a subsidiary of Renergen Limited of approximately AUD4.2 million which has preconditions to its payment and, from 1 January 2023, now accrues interest.”

Further, it added that “as foreshadowed at last year’s Annual General Meeting the Board’s focus has been concentrated on defending the long running Canadian proceedings against the Company’s subsidiary Molopo Energy Canada Limited (MECL) which were commenced in 2011. Since our meeting last year those proceedings are continuing and have now progressed through the discovery process and interrogation of witnesses which has been both detailed and time consuming.

The proceedings involve the claim for damages by 3105682 Nova Scotia ULC (310) against MECL and Crescent Point Holdings Inc and Crescent Point Energy Corp (Crescent Point) arising from the sale of the Company’s subsidiary’s oil and gas assets in 2011. Crescent Point has cross claimed against MECL in relation to potential losses it may incur. The claims for damages by 310 are significant and complex and are being strongly defended by both MECL and Crescent Point but again at significant expense to shareholders. It was anticipated that a court directed mediation would take place in April this year, however, the mediation has now been scheduled for the 5th and 6th December 2023 in Calgary.

The Board will continue to vigorously defend the proceedings.”

Aurora notes that the value of the Funds (AFARF/ABW and AIB) investment in Molopo was written down to nil during the year ended 30 June 2021. The Funds have not adjusted the carrying value of its investment as it is waiting on the outcome of other litigation matters that Molopo is involved in.

The Funds continue to adopt a carrying value of $nil per Molopo share. Aurora will re-assess the carrying value of its investment in Molopo based on further information being released by Molopo regarding its financial position.

Redemptions

Given the uncertainty created by the abovementioned matters, where applicable, Aurora considerers it prudent to maintain a temporary hold on Redemptions until the outcome of the above two (2) matters is known.

- Dated 07/08/23 – Board Changes

Aurora Funds Management Limited (Aurora) is pleased to announce that Mr Jeremy Kriewaldt has been appointed as a Non Executive Director of the Company.

Mr Kriewaldt is a lawyer in private practice, specialising in corporate and commercial law, including mergers and acquisitions, capital raisings and foreign investment, financial product development and securities markets. He started his own practice in 2018 and was previously a partner of Atanaskovic Hartnell (2004 – 2018), Blake Dawson Waldron (now Ashurst) (1990-2003) and served as Counsel to the Takeovers Panel in 2003-2004.

Mr Victor Siciliano who joined the Aurora Board in January 2018 has resigned as a Director of the Company. The Board would like to thank Mr Siciliano for his contribution to the Board during his tenure and wish him all the very best in his future endeavours.

- Dated 23/02/23 – Fund Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Absolute Return Fund (ABW), Aurora Dividend Income Trust (ADIT), Aurora Fortitude Absolute Return Fund (AFARF), Aurora Global Income Trust (AIB), Aurora Property Buy-Write Income Trust (AUP) and HHY Fund (HHY) (collectively the Funds) provides the following market update, where applicable, in relation to the Funds’ investments in RNY Property Trust (RNY) and Molopo Energy Limited (Molopo).

RNY Property Trust update

RNY Property Trust (RNY) is an Australian unlisted property trust with five (5) commercial property assets located in the tri-state area of New York, USA, with 3 properties located in Long Island and 2 properties located in Westchester County, collectively having 830,000 sq feet of lettable office space. Huntley Management Limited is the responsible entity for RNY and Aurora Funds Management Limited is the investment manager.

On 6 October 2020, during COVID-19 (which greatly impacted New York city), Aurora closed a Loan Modification with RNY’s US lender, ACORE Capital (Lender) with a larger facility to fund certain planned capital works (as required by the Lender), with the following key terms:

-

- a three-year term – comprising an initial 6-month term, one six-month extension and two 12-month extension terms following the initial term;

- interest only;

- an existing loan facility of US$76.2 million, with US$64.6 million having been drawn, leaving US$11.6 million available for approved capital expenditures and leasing costs;

- a new mezzanine loan facility of US$15.6 million to fund additional approved leasing costs and capital expenditures; and

- RNY to complete the approved capital expenditure program.

Through the course of 2022, the Lender made various overreaching demands of RNY, including multimillion dollar claims for fees, which Aurora disputes, and demands that all the buildings be sold in an accelerated manner, for total sale consideration that would have amounted to circa US$92 million.

Separately, Aurora worked with an alternate financier (being a Tier 1 financier) to refinance the 3 Long Island properties (representing approximately two thirds of the portfolio’s lettable area), based on a signed Term Sheet for US$60 million of debt finance (before reserves) on those properties at prime lending rates (locked for 10 years in March 2022). The valuations obtained for the three Long Island properties, in an orderly market, to support this alternative financing exceeded US$90 million.

In addition, based on comparable recent sales of properties in the Westchester area, the value of the remaining 2 RNY properties (in Westchester) is in the vicinity of US$30 million, with these buildings having benefited from circa US$7 million of recent capital improvements.

In late 2022, the Lender took steps to enforce its security by seeking to commence foreclosure action, seeking to appoint a receiver, and selling the mezzanine debt in the US properties through a Uniform Commercial Code (UCC) auction process. This UCC process has the result of transferring the equity in the properties to purchaser of the mezzanine finance (which in this case totalled just US$1.7 million). The UCC auction process was ultimately cancelled after RNY’s related entity, RAOC, acquired the mezzanine debt and paid the associated fees (circa US$1 million).

Aurora is actively defending any enforcement actions taken by the Lender, and engaged US Counsel in June 2022 to assist. In addition, Aurora is working to resolve the deadlock situation with the Lender. Until this matter is satisfactorily resolved, and a new debt facility can be agreed, there is significant uncertainty regarding the valuation of the subordinated loans and equity interests in RNY.

RNY Leasing

Following the substantial capital works program, Aurora is encouraged by the current levels of improved leasing velocity. Aurora is however cautious given the current turbulent economic conditions and interest rate environment; and remains optimistic with the short to medium term prospects of the Portfolio. Furthermore, Aurora is pleased with the retention of its current tenants, with minimal reduction in the portfolio occupancy since the on-set of COVID.

Some recent new leasing highlights include:

-

- Full floor tenant (22,128 sq ft) signed with high-credit tenant on commercial terms at Westchester County property.

- Letter of intent with second full floor tenant (circa 22,000 sq ft) at Westchester County property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

- Letter of intent with third full floor tenant (circa 23,000 sq ft) at neighbouring Westchester County property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

- Letter of intent with tenant (circa 10,000 sq ft) at Westchester Country property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

Aurora is diligently working to convert the above-mentioned leases into executed deals. If completed, these prospective leases should materially enhance the occupancy and financial characteristics of the Portfolio.

Molopo Energy update

On 17 December 2021, Molopo Energy Limited (Molopo) advised (on its website) that it had settled the legal action against the former Molopo directors for A$12 million. This equates to 4.8 cents per Molopo share (based on 249,040,648 shares on issue).

Aurora notes that the value of the Funds (AFARF/ABW and AIB) investment in Molopo was written down to nil during the year ended 30 June 2021. The Funds have not adjusted the carrying value of its investment as it is waiting on the outcome of other litigation matters that Molopo is involved in.

The Funds continue to adopt a carrying value of $nil per Molopo share. Aurora will re-assess the carrying value of its investment in Molopo based on further information being released by Molopo regarding its financial position.

Redemptions

Given the uncertainty created by the abovementioned matters, where applicable, Aurora considerers it prudent to maintain a temporary hold on Redemptions until the outcome of the above two (2) matters is known.

Yours faithfully

Aurora Funds Management Limited

John Patton

- Dated 23/03/22 – Fee and Expenses Update

Aurora Funds Management Limited (ACN 092 626 885) (“Aurora”) in its capacity as the responsible entity of the Aurora Dividend Income Trust (“ADIT” or “Fund”) hereby provides 30 days’ notice that it will be implementing a responsible entity fee of $8,333 (ex GST) per month.

- Dated 30/09/20 – RNY Property Trust revaluation

Aurora Funds Management Limited (Aurora), in its capacity as the responsible entity of the Aurora Property BuyWrite Income Trust, Aurora Fortitude Absolute Return Fund, Aurora Global Income Trust and the Aurora Dividend Income Trust (Fund(s)), provides the following update in relation to the RNY Property Trust (RNY).

RNY has been suspended from trading on the Australian Securities Exchange (ASX) since 1 April 2019, due to delays experienced in finalising its audited financial statements for the year ended 31 December 2018 and half year ended 30 June 2019, followed by the Audit Disclaimer Opinion issued in relation to the year ended 31 December 2019. Aurora understands that RNY is due to release its Audit Reviewed financial statements for the half year ended 30 June 2020. In the event a clear audit review statement is issued, Aurora understands that RNY will then be in a position to apply for recommencement of trading on the ASX.

On 23 September 2019, RNY announced it had completed an independent valuation of its 5 commercial office properties in the New York tri-state area, resulting in a 16% uplift on previous valuations and a material uplift in RNY’s Net Tangible Asset (NTA) backing. Given RNY’s suspension from trading on the ASX, there was no actively traded market available for Aurora to determine the market value for RNY’s securities. As such, the independent valuation obtained by RNY was considered the most appropriate basis on which to determine the carrying value of RNY, with Aurora’s direct investments being carried at a small discount to RNY’s improved NTA.

On 29 June 2020, Keybridge Capital Limited (Keybridge) announced its intention to make an off-market all scrip takeover bid for RNY at an implied offer price of $0.011 per RNY unit1 (Keybridge Offer), with its Bidder’s Statement being dispatched on 28 August 2020. On 28 September 2020, Keybridge issued a substantial holder notice stating it had acquired a relevant interest of 1.01% in RNY (from parties other than Aurora) through acceptances into the Keybridge Offer. Aurora has also elected to accept a portion of its Funds holdings into the Keybridge Offer. Consistent with its previous “truth in takeovers” statement, Aurora has limited its acceptances into the Keybridge Offer at 41,450,000 RNY units.

As a consequence of the acceptances into the Keybridge Offer, the implied offer price of $0.011 per RNY unit is now the most readily observable price for RNY securities. As such, this has resulted in the carrying value of Aurora’s direct investments in RNY being reduced from $0.044 to $0.011 per RNY unit, across its various Funds.

Following the recommencement of trading in RNY securities on the ASX, Aurora will continue to adjust its direct investment in RNY to reflect the last traded market price.

This announcement was authorised for release by Aurora’s Managing Director.

- Dated 29/06/20 – ADIT Bid Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Dividend Income Trust (ADIT), the HHY Fund (HHY) and the Aurora Fortitude Absolute Return Fund (AFARF), provides the following update in relation to the ADIT takeover bid for the ordinary shares in Keybridge Capital Limited (Keybridge) which closed on Monday, 6 April 2020.

Read more here.

- Dated 07/04/20 – Close of Takeover Offer – Keybridge Capital (KBC)

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity of the Aurora Dividend Income Trust (ADIT), advises that the offers made by ADIT under its off-market takeover bid for the ordinary shares in Keybridge Capital Limited (Keybridge) closed on Monday, 6 April 2020 pursuant to the terms of those offers.

ADIT received acceptances of 21.20% of the ordinary shares in Keybridge.

Aurora notes that Bentley Capital Limited, who accepted the ADIT offer, has made an application to the Takeovers Panel seeking to have its acceptance reversed.

This notice has been approved by the Board of Aurora.

- Dated 30/03/20 – Second Supplementary Bidder’s Statement

This document is a supplementary bidder’s statement under section 641 of the Corporations Act 2001 (Cth). It is the second supplementary bidder’s statement (Second Supplementary Bidder’s Statement) issued by Aurora Funds Management Limited as responsible entity for the Aurora Dividend Income Trust (ARSN 151 947 732) (ADIT) in relation to its off-market takeover bid for the ordinary shares in Keybridge Capital Limited that ADIT does not already own. This Second Supplementary Bidder’s Statement supplements, and should be read together with, ADIT’s bidder’s statement dated 7 February 2020 (Original Bidder’s Statement) and ADIT’s First Supplementary Bidder’s Statement dated 5 March 2020. This Second Supplementary Bidder’s Statement prevails to the extent of any inconsistency with the Original Bidder’s Statement and First Supplementary Bidder’s Statement. Terms defined in the Original Bidder’s Statement and First Supplementary Bidder’s Statement have the same meaning in this Second Supplementary Bidders Statement. A copy of this Second Supplementary Bidder’s Statement was lodged with ASIC on 30 March 2020. Neither ASIC nor any of its officers takes any responsibility for the content of this Second Supplementary Bidder’s Statement.

Read more here.

- Dated 24/03/20 – ADIT Takeover Bid for the ordinary shares in Keybridge Capital Limited

Aurora Funds Management Limited (ACN 092 626 885), as responsible entity for Aurora Dividend Income Trust (ARSN 151 947 732) (ADIT), refers to the off-market takeover bid for the fully paid ordinary shares in Keybridge Capital Limited (ACN 088 267 190) (KBC).

ADIT’s Supplementary Bidders Statement, dated 5 March 2020, detailed its improved cash consideration of 7.0 cents for each fully paid ordinary share (Improved Bid), which which was subject to Keybridge shareholders being granted the ability to withdraw their acceptances (Withdrawal Condition) from the WAM Active bid.

On 13 March 2020, Aurora announced that ADIT had freed its bid of all defeating conditions which included the Withdrawal Condition. As such, ADIT’s takeover bid for KBC is 7.0 cents per share.

- Dated 13/03/20 – Notice of status of defeating conditions

Aurora Funds Management Limited (ACN 092 626 885), as responsible entity for Aurora Dividend Income Trust (ARSN 151 947 732), refers to the off-market takeover bid for the fully paid ordinary shares in Keybridge Capital Limited (ACN 088 267 190) (KBC), for the improved cash consideration of 7.0 cents for each fully paid ordinary share (Bid).

In accordance with section 650F(3)(a) of the Corporations Act 2001(Cth) (Act), we enclose a notice under section 650F(1) of the Act in relation to freeing the Bid of defeating conditions.

- Dated 10/03/20 – Off-Market Takeover Bid for Keybridge Capital Limited (ASX: KBC)

Aurora Funds Management Limited (Aurora), as responsible entity for the Aurora Dividend Income Trust (ADIT) in accordance with section 633(1) item 8 of the Corporations Act 2001 (Cth), gives notice that on 6 March 2020, it dispatched its Bidder’s Statement dated 7 February 2020 and Supplementary Bidder’s Statement dated 5 March 2020 in relation to its takeover bid for all of the ordinary shares in Keybridge Capital Limited (ACN 088 267 190) (Keybridge) (Bid).

The Bid is open for acceptance and ADIT encourages Keybridge shareholders to accept the Bid as soon as possible, noting however that the Bid currently remains conditional.

The Bid is currently scheduled to close at 7.00pm (AEST) on 6 April 2020, unless extended or withdrawn.

The release of the Bidder’s Statement and this announcement is authorised by the Board of Aurora.

- Dated 06/03/20 – Aurora Dividend Income Trust – Keybridge Capital Limited (ASX: KBC) Bidders Statement UPDATED

Aurora Funds Management Limited as responsible entity for the Aurora Dividend Income Trust (ADIT) is offering to acquire all of your fully paid ordinary shares in Keybridge Capital Limited (ASX: KBC) issued on or before 10 February 2020, through the Bid contained in this Bidder’s Statement.

Read the Bidders Statement here.

- Dated 05/03/20 – Aurora Dividend Income Trust – Keybridge Capital Limited (ASX: KBC) Supplementary Bidders Statement

Aurora Funds Management Limited as responsible entity for the Aurora Dividend Income Trust (ADIT) is offering to acquire all of your fully paid ordinary shares in Keybridge Capital Limited (ASX: KBC) issued on or before 10 February 2020, through the Bid contained in this Bidder’s Statement.

Read the Bidders Statement here.

- Dated 03/03/20 – Aurora Dividend Income Trust – Keybridge Capital Limited (ASX: KBC) Takeover Bid Update

Aurora Funds Management Limited (Aurora), as responsible entity for the Aurora Dividend Income Trust (ARSN 151 947 732) (ADIT or Fund), announces that it proposes, if certain conditions (as set out below) are satisfied, to vary its off-market takeover bid for the fully paid ordinary shares in Keybridge Capital Limited (ACN 088 267 190) (KBC)1 , by increasing the cash consideration offered from 6.6 cents (Initial Bid) to 7.0 cents for each fully paid ordinary share (Improved Bid).

Conditional Increase in ADIT’s Bid consideration

ADIT’s Initial Bid is 6.6 cents cash per KBC share. However, ADIT will increase its bid to 7.0 cents cash per KBC share on the condition that Target shareholders are able to withdraw their acceptances from the WAM Active takeover offer dated 3 January 2020. All other conditions in the Initial Bid, as announced on 8 January 2020, remain the same.

ADIT is planning to release its Bidder’s Statement shortly.

- Dated 25/02/20 – Aurora Dividend Income Trust – Keybridge Capital Limited (ASX: KBC)

Aurora Funds Management Limited (Aurora), as responsible entity for the Aurora Dividend Income Trust (ARSN 151 947 732) (ADIT or Fund), refers to the announcement by WAM Active

Limited on 24 February 2020, increasing its off-market takeover bid for the fully paid ordinary shares in Keybridge Capital Limited (ACN 088 267 190) (KBC) to 6.9 cents per share and

removing a number of its bid conditions.

Aurora is currently considering the implications of the WAM Active announcement and will provide an update in due course on what impact it has on the ADIT Bid Announcement.

- Dated 07/02/20 – Lodgement of Biddders Statements for Keybridge Capital Limited and Notice of Register Date

Aurora Funds Management Limited (Aurora), as responsible entity for the Aurora Dividend Income Trust (ADIT), refers to the 8 January 2020 ASX Announcement of its intention to make a conditional off-market takeover bid for all of the fully paid ordinary shares in Keybridge Capital Limited (ASX: KBC) (Keybridge) for a consideration of 6.6 cents per ordinary share (the Bid).

Aurora confirms that its Bidder’s Statement has been lodged with ASIC and served on Keybridge today in the form attached to this announcement.

Aurora also notifies ASX that it has set the “Register Date” as 10 February 2020, for the purposes of sections 633(2) and 633(3) of the of the Corporations Act 2001(C’th).

Read more here.

- Dated 08/01/20 – Off-market takeover bid for Keybridge Capital Limited (ASX:KBC)

Aurora Funds Management Limited (Aurora), as responsible entity of ADIT, is pleased to announce ADIT’s intention to make an off-market takeover bid for the fully paid ordinary shares in KBC at an all cash bid price of 6.6 cents for each share (Bid).

The shares in KBC have not traded on the ASX since being suspended on 16 July 2019. The Bid consideration represents an 8.9% premium to KBC’s most recent net tangible asset backing of 6.06 cents per share as at 31 October 2019 and a premium of 1.5% to the takeover offer made by WAM Active Limited.

Read more here.

- Dated 08/01/20 – Appointment of New Chief Financial Officer and Company Secretary

Aurora Funds Management Limited, as Responsible Entity the Aurora Dividend Income Trust announces that Mr Adrian Tilley has resigned as Chief Financial Officer and Company Secretary to take up a role in his family business in his regional hometown of South Gippsland, Victoria. The Board acknowledges the substantial contribution made by Mr Tilley during his tenure with Aurora and sincerely wishes him all the very best in his future endeavours.

Aurora is pleased to announce that Mr Mark Briglia has been appointed to the role of Chief Financial Officer and Company Secretary. Mr Briglia’s most recent role was as Chief Financial Officer and Group Manager, Australian Energy Market Operator. Mr Briglia has deep industry experience across a number of sectors at the executive level both in Australia and internationally. In addition, he is a Certified Practicing Accountant and holds a Master of Business Administration and a Bachelor of Commerce (University of Melbourne).

Mark will also replace Adrian Tilley as the internal member of Aurora’s Compliance Committee.

- Dated 01/11/19 – Interactive Brokers – Update

Aurora Funds Management Limited (“Aurora”) provides the following update in respect of a material service provider to the Aurora Dividend Income Trust (“ADIT”).

Interactive Brokers

Interactive Brokers LLC (“IB LLC”), the prime broker and custodian of ADIT, has advised that it intends to cease operations in Australia. ADIT has executed a Deed of Novation to transfer its account from IB LLC to Interactive Brokers Australia Pty Ltd (“IB Australia”) (ABN 98 166 929 56), which has been set up by Interactive Brokers in order to continue to provide services to its Australian clients.

- Dated 09/04/19 – Off-market redemptions Takeover Bid

On 5 April 2019, Aurora Funds Management Limited (Aurora), as responsible entity of the Aurora Dividend Income Trust (ARSN 151 947 732) (“ADIT” or “Fund”), announced ADIT’s intention to make an off-market scrip takeover bid (Bid) for all of the shares in 8IP Emerging Companies Limited (“8EC”). As a result of this Bid, Aurora would like to note the following temporary change to ADIT’s off-market redemption facilities.

Impact on Off-market redemptions

Certain provision of the Corporations Act prohibits trading in target securities during a bid period. Those provisions apply to 8EC shares during the bid period of the Bid. Currently, the majority of ADIT’s Net Asset Value (NAV) is invested in 8EC shares. Therefore, ADIT will not have the ability during its Bid to dispose of any 8EC securities to meet potential prospective redemptions. Therefore, in lieu of alternative liquidity options which are currently available to ADIT, including raising new funds from equity or debt, the Fund’s liquidity will be temporarily constrained during the Bid period. As a result, effective immediately, Aurora hereby provides notice that it will not be accepting any new off-market redemptions until the earlier of ADIT Bid closing, or Aurora providing further update on the off-market redemption facility for the Fund. This change only affects redemptions received after this notice. Outstanding redemptions prior to this notice will not be affected.

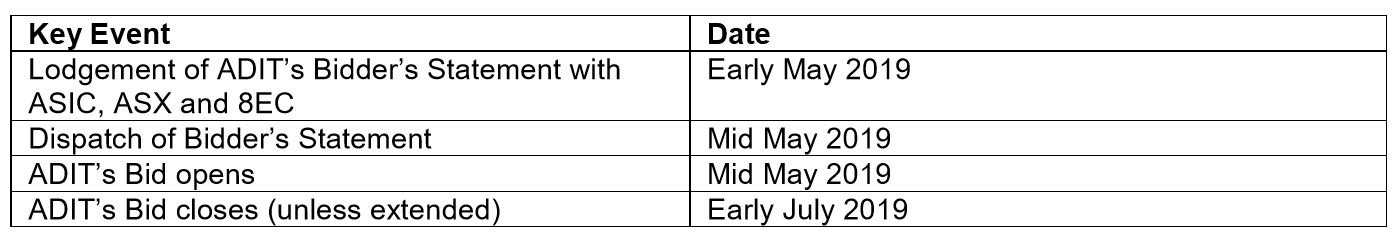

Please see expected Bid timetable per Aurora’s 5 April 2019 announcement:

Further information

If you have any queries in relation to the Bid, please contact Aurora on 1300 553 431.

- Dated 05/04/19 – Aurora Dividend Income Trust announces off-market all scrip takeover bid for 8IP Emerging Companies Limited (ASX:8EC)

Aurora Funds Management Limited (Aurora), as responsible entity of the Aurora Dividend Income Trust (ARSN 151 947 732) (“ADIT” or “Fund”), is pleased to announce ADIT’s intention to make an off-market scrip takeover bid (Bid) for all of the shares in 8EC. Each 8EC shareholder who accepts the Bid will receive ADIT units2 equal to the value of $0.75.

Read more here.

- Dated 21/12/18 – AQUA Product Issuer Status

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Dividend Income Trust (AOD or Fund), acknowledges but disagrees with the decision made by the ASX to revoke Aurora as an AQUA Product Issuer, as outlined in their ASX announcement on 20 December 2018.

Fund Operations

The Fund will continue to operate as unlisted managed investment scheme and continue to execute its investment strategy as outlined in the Fund’s Product Disclosure Statement (PDS). AOD unitholders can apply for, and redeem, units off-market in accordance with the terms set forth in the Fund’s PDS. For further information on the off-market application and redemption facility, please visit Aurora’s website for a copy of the Fund’s PDS.

Cost Savings

The removal of the Fund from the AQUA platform will result in AOD unitholders benefitting from no ASX listing fees, saving unitholders approximating 1% of Net Asset Value per annum.

- Dated 29/06/18 – Investment Strategy – Position Limit Clarification

Aurora Funds Management Limited (ACN 092 626 885) (Aurora) in its capacity as responsible entity for Aurora Dividend Income Trust (AOD), provides the following update in relation to AOD’s position limits:

Position Limit Clarification

Pursuant to AOD’s current Product Disclosure Statement dated 2 August 2017 (PDS), and due to the nature of such investment vehicles, Aurora adopts a ‘look through’ disclosure for all fees and expenses attributable to AOD from third party investee Listed Investment Companies (LIC) or Listed Investment Trusts (LIT) (i.e. the additional fees of investing in such vehicles are not passed through to unit holders). Aurora wishes to clarify that it also adopts a ‘look through’ approach when considering its concentration in specific security holdings pursuant to the PDS (i.e. the holding in any of AOD’s third party LIC or LIT investments is considered to be a holding in its separate underlying investments and not as a single holding).

The current PDS for AOD states the following:

Aurora aims to invest the Fund, generally, in a portfolio of 10-25 companies and other entities, however, concentrated positions of up to 60% of the Fund’s NAV may be held in a single position during periods that Aurora is actively engaging with an investee entity. Where the Fund holds concentrated positions, this may increase volatility in NAV.

Currently, AOD has a holding in in the Listed Investment Company (LIC) 8IP Emerging Companies Ltd (8EC) that exceeds the 60% of the total value of the Fund’s Net Asset Value (NAV). AOD’s largest single look through ownership in less than 5.0% of NAV1 based on 8EC’s most recent public information.

1 Based on 74% of AOD’s NAV being invested in 8EC, and 8EC single largest investment being 6.7%.

- Dated 26/05/17 – Suspension from Trading Update

Further to the announcement dated 27 April 2017 in relation to AOD’s suspension from trading while its Product Disclosure Statement (“PDS”) is being refreshed, Aurora Funds Management Limited (“Aurora”) advises that the new PDS is expected to be available around 30 June 2017.

This voluntary suspension does not affect any other investment funds managed by Aurora.

We note that during the period of the suspension:

▪ Off-market redemptions for AOD unit holders will continue to be processed in the ordinary course;

▪ Daily updates to AOD’s Net Tangible Assets and investor communication will continue in the ordinary course;

▪ Franked dividend payments from AOD will continue to be paid in the ordinary course;

▪ AOD will continue to accept applications from wholesale investors; and

▪ All terms in AOD’s previously released PDS will continue to apply save as varied in accordance with the terms of the PDS and the voluntary suspension.

- Dated 26/04/17 – Appointment of Chief Operating Officer

Aurora Funds Management Limited is pleased to announce it has expanded its management team with the appointment of Mr Ben Norman to the role of Chief Operating Officer, effective 26 April 2017.

Ben is a qualified Chartered Accountant, with over 16 years of professional and industry experience. Prior to joining Aurora, Ben was a Director in Ernst & Young’s Transaction Advisory Services division, where he spent over 9 years working on numerous due diligence, performance improvement, restructuring, turnaround, financial modelling and transaction integration engagements with clients in all industry sectors. While working with Ernst & Young, Ben also performed extended secondments with global financier GE Capital in a senior risk and compliance role and with ASX listed Origin Energy Limited as a finance manager in Origin’s upstream business.

Prior to joining Ernst & Young, Ben held a senior finance position with gas transmission business Epic Energy (which was owned by the ASX listed Hastings Diversified Utilities Fund, backed by Westpac Banking Corporation) where he was responsible for overall financial control and compliance.

Managing Director, John Patton, commented, “we are delighted to have secured the services of a very senior and experienced industry professional to Aurora’s management team. Ben Norman’s extensive professional and industry experience will be a valuable addition to Aurora’s capabilities”.

Operational Update

In light of the changes that have taken place within the business, Aurora has decided to update and refresh its Product Disclosure Statement (PDS). Pending this review being finalized, Aurora has withdrawn its PDS for new retail applications, however all existing terms will continue to apply save as varied in accordance with the terms of the PDS. Upon the lodgment of an updated PDS, the fund will then accept applications from new retail investors.

- Dated 22/12/2016 – Change of Registered Office

Aurora Funds Management Limited’s Registered Office and Principal Place of Business will change with effect from today, 22 December 2016, with new details as follows:

Suite 613

Level 6

370 St Kilda Road

Melbourne, Victoria 3004

Tel: 1300 553 431

Email: enquiries@aurorafunds.com.au

- Dated 27/10/2016 – Enhancement to Investment Strategy

Aurora Funds Management Limited as responsible entity for Aurora Dividend Income Trust (AOD), is pleased to notify investors of its intention to enhance the investment strategy of AOD by broadening the investment mandate to allow investments in ASX listed companies outside the S&P/ASX200 index, effective 28 November 2016.

The Trust’s present investment strategy, of investing in a portfolio of ASX listed companies that the Investment Manager expects will pay fully franked dividends while employing a risk management overlay to reduce the net exposure to equity market risk, will not change.

An updated Product Disclosure Statement will be issued shortly.

- Dated 27/10/2016 – Investments

Aurora Funds Management Limited (AFML) in conjunction with the Aurora Fortitude Absolute Return Fund (AFARF) has become an investor in the Aurora Dividend Income Trust (ASX: AOD).

The rationale for these investments is as follows:

-

- AFML has invested a portion of its funds in AOD in support of the investment activities undertaken by AOD further aligning the manager with the performance of the fund;

- AFARF has a relatively high level of cash on hand at present, enabling redemption requests to be processed quickly and efficiently. As such, the investment by AFARF in the AOD enables a portion of these funds to be actively managed on an ‘at call’ basis;

- AFML will rebate all management fees charged in AOD to AFARF to ensure no increased management expense to investors; and

- With an expanded investment pool within AOD, it follows that this should lead to a lower Management Expense Ratio for this fund.

- Dated 08/07/2016 – Operating Expenses

Effective 8 August 2016, Aurora Funds Management Limited may begin charging all of its normal operating expenses to the Trust, which may be higher than the cap used in the past, in accordance with the Constitution.

- Dated 18/9/2015 – Annual Reporting and Fund Disclosure as at 30th June 2015

Asset Allocation: 47% invested in equities after hedging & 53% invested in cash after hedging.

Liquidity Profile: 100% within 2 business days.

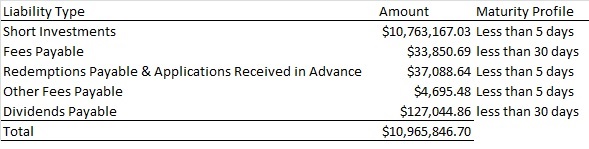

Maturity Profile of fund’s liabilities:

Leverage: N/A

Derivative Counterparties: UBS AG.

Investment Returns: -5.26% for the 2014/15 financial year.

ICR to 30 June 2015: 1.28%

Key Service Providers: No change.

-

-

- Dated 20/8/2013 – Change of Name

-

The Aurora Sandringham Dividend Income Trust first listed in November 2005 is now listed under the ASX AQUA Rules. The new name of the listed Unit is the Aurora Dividend Income Trust – Quoted Unit which will continue to trade under ASX Code: AOD..

One of the benefits to investors is that the Net Asset Value of the Trust is available on the home page of our website under the “Live Net Asset Values” table. This “iNAV” is updated every minute during trading hours.

-

-

- Dated 3/9/2012 – Reduction in Fees

-

Effective 1 November 2012 the Aurora Dividend Income Trust (ARSN 151 947 732, APIR Code: AFM0010AU) will cease to charge a performance fee. The Aurora Sandringham Dividend Income Trust invests into the Aurora Dividend Income Trust and does not charge any additional fees.

-

-

- Dated 2/7/2012 – GST Update

-

On 29 May 2012, amendments to the GST financial services regulations were released, including wide ranging new regulations relating to the reduced input tax credit treatment of supplies acquired by managed investment schemes and superannuation funds. The new rules apply from 1 July 2012.

The amendment regulations introduce a new item 32 of GST regulation 70-5.02(2) under which supplies acquired by a ‘recognised trust scheme’ on or after 1 July 2012 will be eligible for a 55% reduced input tax credit (RITC). Certain specified services will remain eligible for the 75% RITC.

-

-

- Dated 15/03/2012 – Contribution Fee Removed

-

It is intended that from 16 April 2012 the Aurora Dividend Income Trust will move to accruing performance fees on a daily basis instead of the current process of accruing monthly.

-

-

- Dated 21/12/2011

-

i. This notice is to advise current and future investors that as at 1 February 2012 the Trust (Aurora Sandringham Dividend Income Trust) will reintroduce a normal expense recovery capped at 0.3075% (including GST) per annum – via ADIT. This expense recovery has been temporarily suspended since 1 October 2011.

-

-

- Dated 22/08/2011

-

i. The Aurora Sandringham Dividend Income Trust’s management fee will be reduced to 0.95% per annum (plus GST) on Net Asset Value, and the capped expense recovery will be reduced to zero effective 1 October 2011.

ii. The investment objective will change to maintain a net exposure to equities in the S&P/ASX 200 Index in the range of 40% – 60% of the net asset value of the Trust on continuous basis with a target of 50% (from the previously announced range of 40-75%), effective 1 October 2011

iii. The Investment Manager will no longer use derivatives or borrowings to gear the portfolio, and may not short securities with a total value of more than 60% of the Net Asset Value of the Trust, effective 1 October 2011