Liquidity Solution for Aurora Fortitude Absolute Return Fund

Aurora Funds Management Limited (“Aurora”) is pleased to announce some important changes to the Aurora Fortitude Absolute Return Fund (“the Fund”).

As you may be aware, on 25 February 2016, applications, redemptions and distribution reinvestments were temporarily suspended as a result of the Fund holding Convertible Notes (AZZG) issued by Antares Energy Limited (“Antares”). At the time, Antares had been suspended from trading on the ASX and as such the AZZG Notes were considered illiquid. Subsequently, on 28 April 2016, the directors of Antares placed the business into Administration with FTI Consulting ultimately being appointed as the Administrators of Antares. FTI Consulting remain in place as the Administrators today.

Since this time, Aurora has been working to deliver an equitable liquidity solution for investors.

Aurora can now confirm that an off market liquidity solution will be made available for those investors wishing to redeem their investment from the Fund. Redemption requests will be satisfied by a combination of cash (approximately 90% of the investment value, based on the Fund’s current portfolio), with the balance to be satisfied from the currently illiquid portion of the Fund’s investments as and when they become liquid. To assist with transparency, the Fund will treat the illiquid component of an investor’s underlying investment in the Fund (AZZG plus a residual amount of cash to fund the associated costs) as a separate pool.

In our view, this liquidity solution results in a fair outcome for all unitholders as it provides investors with an opportunity to redeem the liquid portion of their investment whilst retaining an entitlement to the illiquid portion (which will be realised in due course). The ongoing integrity of the Fund is also preserved for remaining unitholders, and those seeking to exit the Fund will be able to receive the majority of their investment in cash.

How the liquidity solution will work

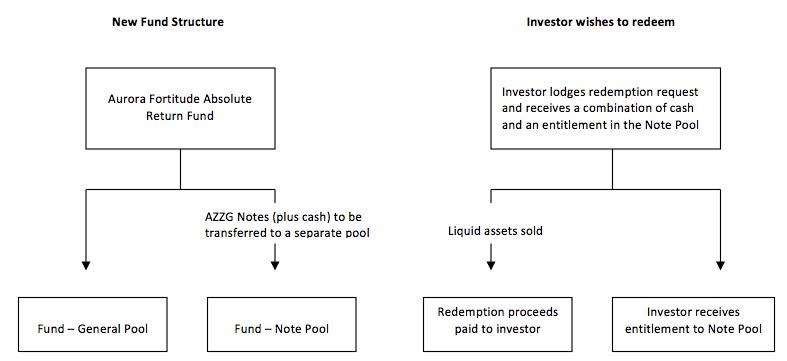

The Fund will notionally create two (2) pools, being the Aurora Fortitude Absolute Return Fund General Pool (“General Pool”) and the Aurora Fortitude Absolute Return Fund Note Pool (“Note Pool”). The illiquid investment, AZZG, will be transferred to the Note Pool along with some cash to fund the Administration, with the remaining liquid investments being held in the General Pool. All existing investors will have proportional exposure to both Pools.

Investors wishing to withdraw their investment will have redemptions satisfied by a combination of cash from the General Pool (circa 90%, based on the Fund’s current portfolio) and an entitlement to the Note Pool (circa 10%).

The Note Pool will continue to be managed by the Fund and realised over time, which is expected to be in the vicinity of 12 months (although Aurora cannot guarantee this timeframe – a significant timing issue for the Fund is the timing of reports from the Administrator of Antares to creditors, including the Fund). The Fund’s priority is to maximise returns for all investors from the AZZG position.

It is currently contemplated that Aurora will, in due course, establish a separate Special Purpose Vehicle (“SPV”), managed by Aurora, to enable the assets in the Note Pool to be transferred across to the SPV. The SPV would also be able to hold any AZZG Notes currently held by other Aurora Funds. Simultaneously, ownership of the SPV would be transferred in-specie to all unitholders, in proportion to their original investment. This would then enable each of the Aurora funds (impacted by the AZZG Notes) to be unfrozen.

This mechanism will also enable the distribution reinvestment plan to be reintroduced.

Currently, clause 7.7 of the Fund Constitution requires the Responsible Entity to cancel those Units that have been redeemed. Given the creation of two (2) Pools, the Responsible Entity has determined that the rights of unitholders would not be adversely impacted if the Constitution were to be amended to enable units in the General Pool to be cancelled, whilst units in the Note Pool remain on foot.

The current Product Disclosure Statement (“PDS”) contemplates 90% of the Fund’s assets being able to be liquidated within 10 business days. To facilitate the normal functioning of the Fund, whilst the Note Pool is in place, the Fund will revert to the liquidity requirements contained in its Constitution, which is consistent with the Corporations Act.

The PDS will also be amended to make it clear to all new unitholders that any new investment will only have an entitlement to the General Pool.

The Responsible Entity is of the opinion that the creation of two (2) Pools, and establishment of the SPV in due course, will enable existing unitholders to ultimately maximise their investment returns. To facilitate this change to the Fund structure, the Responsible Entity has decided to exercise its power under the Fund’s Constitution to introduce a withdrawal fee equal to 1.85%, excluding any GST, of the redemption amount.

The team at Aurora welcome the resolution of the liquidity situation. With this impediment now removed, we look forward to continuing our strong track record of generating risk-adjusted returns for our investors.

Timetable

Redemption requests can now be submitted immediately, with redemptions to be processed on the last business day of each calendar month, pursuant to the Fund’s Constitution. Due to financial year-end, the next redemption day will be Wednesday 31 August 2016, with proceeds from a redemption request likely to be received within 14 business days thereafter.

What to do if you wish to remain invested in the Fund

If you wish to remain invested in the Fund, you don’t need to do anything. Your investment will continue to:

- Pay quarterly distributions; and

- Be actively managed according to the Fund’s investment objective.

What to do if you wish redeem

Should you wish to withdraw part or all of your investment, you will need to:

- Download a redemption form from our website at Redemption Form;

- Read and consider the Aurora Absolute Return Fund PDS available from www.aurorafunds.com.au; and

- Obtain financial and taxation advice on whether redemption is appropriate for you and your financial position. In relation to taxation, the right to obtain a further amount from the Note Pool may have a value depending on the value of the AZZG notes which you may need to add to your cash receipt in determining the tax consequences to you of redemption of your Units.

The unit registry, One Registry Services will send you a confirmation of your redemption and your entitlement to the Note Pool (including the per Unit value of the net asset value of the Note Pool shown in the latest audited accounts of the Fund). You should keep this documentation for your records. One Registry Services can be contacted on (02) 8188 1510.

A print version is available here.